According to the United Nations’ World Population Dashboard, India became the world’s most populous country in 2023, with a population of 1.4 billion people. It also has a young population; the country’s median age was 28 in 2022, compared with 37 in Australia and 38 in the United States[1].

However, relative to its large population, India’s wine consumption by volume is low. India’s still wine consumption per capita is 0.02 litres per annum, placing them in 50th place in 2021. In comparison, Australia sits in 18th place, consuming 21 litres per annum.

Complex taxation regime

As touched on in the Austrade webinars released in August 2022, India’s taxation regime is complex and each state has an individual taxation regime.

Wine is expensive compared to other alcohol beverages, partially from high taxes and import duties, and this limits the pool of consumers to higher income urbanities[2]. On average, wine is double the price of spirits and almost three and a half times the price of beer[3]. In addition to the complex taxation regime, laws can differ state-to-state, with alcohol prohibited in some.

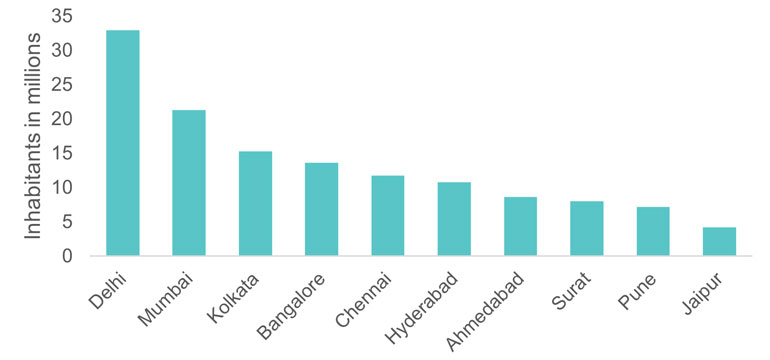

Across India’s 28 states, the country has diverse cultures and religious beliefs, which also lead to variations in consumption patterns across the country. While alcohol consumption by city is currently not accessible from official sources, larger cities are known to have higher levels of alcohol consumption due to higher income levels and social trends. According to Wine Intelligence, semi-annual wine drinkers in India are concentrated in the top 10 largest cities in the country (Figure 1); 27 per cent of wine drinkers reside in Mumbai, 20 per cent reside in Delhi, 15 per cent reside in Bangalore and 10 per cent reside in Kolkata.

Figure 1: Top 10 largest cities in India in 2023

Source: Statista

Wine Intelligence reported in 2022 that around a third (17 million) of the 52 million adults in selected urban areas are semi-annual wine drinkers and 90 per cent (15 million) drink wine at least once a month.

Collectively, they consumed 2 million cases of wine valued at US $392 million in 2022 ranking India’s wine consumption at 62nd by volume and 47th by retail value globally. Although from a low base, volumes grew with a compound annual growth rate (CAGR) of 8 per cent from 2017 to 2022 and is forecast to grow with a CAGR of 7 per cent through to 2027.

However, looking at all alcohol beverage categories, India’s total alcohol consumption (689 million 9 litre cases) in 2022 was higher than Australia (309 million 9 litre cases)[4]. This is because India’s large population consumes mainly spirits (53 per cent of volume) and beer (46 per cent) whereas wine made up less than 1 per cent in of total alcohol volume in 2022.

India ranked the 33rd most attractive wine market

Despite wine’s small market share, the Wine Intelligence’s Global Compass 2023 has ranked India as the 33rd most attractive market for both still and sparkling wine.

India is classified as a ‘New Emerging’ market, which is a market where wine is still a relatively new and unknown beverage but showing potential.

It’s estimated that another 283 million people will join India’s middle classes by 2031[5] and their working age population is expected to reach 1.1 billion by 2050.

India is also experiencing rapid urbanisation[6] each year, as outlined in Figure 2, representing a growing opportunity for the wine market.

A third of respondents surveyed by Wine Intelligence were categorised to have a lower-medium monthly household income of INR 75,001 – INR 100,000 (roughly AUD $2000). This category of household income also consumed wine most frequently and were more likely to consider wine important to their lifestyle.

However, it should be noted that the World Bank reports almost half of India’s population (46.54%) are living below the lower-middle income poverty line of US$3.65 per day[7].

Figure 2: Degree of urbanisation

Source: World Bank: World Development Indicators

According to India Wine Landscapes 2022, India’s wine drinking population are typically under 40 years old with an even gender split. The youngest drinkers, Gen Z, are the most knowledgeable about wine, in contrast to other markets where older drinkers tend to be most knowledgeable.

Local and Australian wine dominate the market

In the Asia Pacific region, India is classified as the eighth largest wine market by volume and tenth largest by retail value in 2022, according to IWSR data.

Unlike most emerging markets in Asia Pacific, where the majority of all wine is imported, India also has a local wine production industry. India’s wines are mostly consumed domestically and hold 69 per cent of the volume of all wine consumed in India (Figure 3).

Figure 3: Emerging markets in Asia volume of local vs imported wine in 2022

The proportion of local and imported wine over the decade has remained relatively stable over the years, with total volumes increasing year-on-year, indicating an increase in demand for wine in India (apart from 2020 during the COVID-19 pandemic).

Interestingly, in a Wine Intelligence study, Indian wine scored the lowest quality perception of all origins tested (8.5 out of 10). On the other hand, Australia came in third place, equal with California (8.9)[8], which could explain imported wine growing at a slightly higher CAGR over the last 5 years (9 per cent) compared with local wine (7 per cent).

In 2022, India imported 7.8 million litres of wine, which equates to around 10 million standard bottles of wine. Although local wine has the majority share of the market, Australia is the top source country for imported wine with 42 per cent market share of the imported wine market, followed by Italy with 14 per cent market share, Chile with 11 per cent market share and France with 9 per cent market share by volume in 2022 (Figure 4).

Figure 4: Top Source Country for Imported Wine by Volume in 2022

Source: Trade Data Monitor

According to IWSR, more than three quarters of India’s wine consumption is still wine (85 per cent), followed by sparkling wine (14 per cent) and fortified wine (1 per cent) in 2022. These proportions are reflected in the market share of imported wines during the same year where 66 per cent are bottled, 26 per cent are bulk and 8 per cent are sparkling[9].

Of the top countries of origin of still wine by volume in India, the average retail price is US$25. Local still wine retails for half the average price at US$12. Among the top countries of origin, Australia has the lowest average price at US$19. Despite this, Australian still wine is priced slightly higher in India compared to other Asian markets such as Japan (US$8), South Korea (US$15) and Hong Kong (US$16).

As for sparkling wine, the average retail price is US$35. Similarly, local sparkling retails for almost three and a half times less at US$10. The lowest average price is recorded by the United States at US$23, followed by Italy at US$25, Spain, Germany and Australia at US$27, South Africa at US$35 and lastly France at US$105.

Indian consumers normally order wine by the colour, rather than the variety, and according to Wine Intelligence, red wine is the preference with 84 per cent of semi-annual wine drinkers having drunk it this year, compared with 49 per cent consuming white wine.

The top wine buying choice cues are brand, taste and alcohol content. Awareness of Australian wine is in sixth place, behind India, France, Italy, Spain and California.

Awareness and country of origin consumption ranking (percentage who have drunk from the following country in the last 6 months) are roughly the same suggesting some correlation. According to Wine Intelligence, Australia’s popularity could be a result of its positive imagery, as it over indexes for offering authentic wines for special occasions that drinkers would be happy to recommend[10].

Consumption behaviour in the on-trade and off-trade

In 2022, around 40 per cent of wine was consumed on-premise (in restaurants/bars) and 60 per cent off-premise (Figure 5). The ratios have reversed compared to 2019, where slightly more than 70 per cent of wine was consumed on-premise and almost 30 per cent consumed off-premise.

IWSR reported that post-pandemic, many establishments did not buy or renew their licenses due to uncertainties of pandemic lockdowns. This could have led to fewer on-premise locations, which slowed the on-premise recovery.

Figure 5: ‘What is the share of on vs off-premise in each market?’ – Market Explorer

Source: Market Explorer

According to Wine Intelligence, there is evidence of premiumisation in both the on-premise and off-premise compared to 2019. Currently, average spend in the off-premise is over INR 1,060 (A$20) during informal occasions and slightly higher during formal occasions, whereas average spend in the on-trade is high, at over INR 3000 (A$55).

Men spend higher in the off-premise than women per bottle. In contrast, women have a greater presence and spend higher in the on-trade, with an average spend of about INR 500 higher (A$10) than men. This may be driven by women recording higher involvement in wine than men, viewing it as important to their lifestyle and possessing a strong interest in it.

In addition, the variation in gender proportions in the on-trade reflects the different drinking habits between genders, influenced by the perception that wine is a socially acceptable drink for women to be seen consuming when out, while men prefer to switch to spirits and other categories.

Demand for premium Australian exports growing

According to Wine Intelligence Country Health Tracking June 2023, nearly 3 million consumers have drunk Australian wine at least once in the past six months.

India was Australia’s 22nd largest export market by volume in 2022–23. It has climbed nearly 10 places since a decade ago as Australian exports to India experienced a high growth over the past decade with a CAGR of 12 per cent by volume and 15 per cent by value (Figure 6).

Year-on-year performance was negative from 2020 to 2021 due to the pandemic, but exports experienced considerable growth in year 2022 as the economy started to recover and the lead up to the Australia–India Economic Cooperation and Trade Agreement (AI ECTA), which came into force in 29 December 2022.

Looking forward, IWSR data projects Australian still wine will continue to grow with a CAGR of 6 per cent through to 2027.

Figure 6: Australian wine exports to India

In terms of wine style, 70 per cent of Australian exports to India are still red, 25 per cent are still white, 4 per cent are sparkling and 1 per cent is still rosé (Figure 7).

In 2022–23, Australia’s top exported varieties were Shiraz blends (51 per cent of volume), followed by Chardonnay (24 per cent), Shiraz (10 per cent), Merlot (5 per cent) and Cabernet Sauvignon (3 per cent).

Figure 7: Australian exports (volume share) by wine style in 2022–23

In 2022–23, 89 per cent of Australia shipments to India were at an average value of A$2.50 to A$4.99 per litre FOB. Although less volume was shipped in the higher price points to the Indian market, AI ECTA is hoped to boost the attractiveness of premium wine through the reduction of tariffs on roughly the above A$8 per litre FOB price point and further reductions above A$26 per litre over a period of 10 years.

The positive impact of the tariff reduction can already be seen in Figure 8 where the premium price segments grew by 4 percentage points to 6 per cent volume share, just 6 months after the agreement was signed in December 2022.

Figure 8: Australian exports (volume share) to India by above $7.50 price segment

IWSR forecasts the price segments benefiting from the tariffs (premium and above) to grow at a faster rate (CAGR of 15 per cent) than the price segments which do not benefit from the tariff (CAGR of 6 per cent) through to 2027.

1. UN World Population Prospects

2. Wine Intelligence India Wine Landscapes 2022

3. Statista

4. IWSR India 2023

5. ICE360 household survey

6. Series: Urban Population (% of total population), which refers to people living in urban areas as defined by national statistical offices. There is no consistent and universally accepted standard for distinguishing urban from rural areas. Some define urban areas based on the presence of certain infrastructure and services.

7. https://pip.worldbank.org/country-profiles/IND

8. Wine Intelligence Country Health Tracking June 2023

9. Trade Data Monitor

10. Wine Intelligence Country Health Tracking June 2023